Stock Market Early Morning Insights – June 9, 2016

Stock Market Early Morning Insights – June 9, 2016

Yesterday was a strange day. The risk trade is clearly on with the S&P 600 small-cap and the S&P 400 and mid-cap stocks pushing higher, yet money was also flowing into defensive groups such as Utilities and the Defensive stocks group located in the Woodward and Brown user groups.

Another anomaly was that oil was up around 2%, but the Energy sector was one of the weakest groups in the database. The XLE Energy SPDR was down .2% for the day and the SPDR Oil and Gas Exploration and Production ETF, the XOP, was down .8%. This could be a warning that these sectors are overbought and need a break.

Some of the strongest accumulation and money flow was into the XME, the SPDR S&P Metals and Mining ETF was up 4.1%. There is a story on Bloomberg this morning the George Soros is back actively managing his own money and is heavy into Gold and other precious metals.

He is very nervous about a market meltdown originating in China or credit has been lose, and banks are holding a lot of bad debt. Soros isn’t the only one playing this card because the precious metals and mining stocks have been on a tear all year.

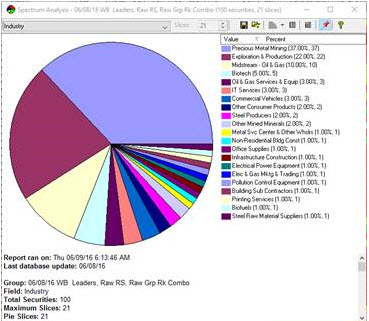

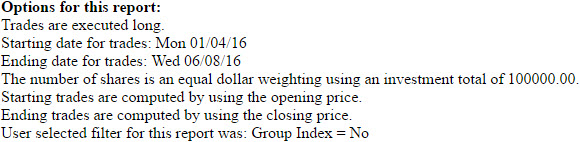

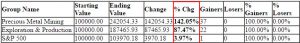

This is a view of the top 100 ranked stocks based upon my Raw RS and Raw Grp Rank SmartGroup. The group is dominated by the Precious Metals and Mining stocks and the Exploration and Production stocks which have had tremendous gains this year. When trends start, they have a tendency to go on a lot longer than anyone expects, especially if you are on the wrong side of those trades.

These groups have appeared over and over in the Stocks and Groups Moving to the Upside, the Top 50 GIR, and the WB Leaders, Raw RS and Raw Grp Rank SmartGroup. You will not find many, if any, CAN SLIM stocks in these groups, and this is a great example of why earnings do not matter much of the time. Traders anticipate future earnings, not necessarily what has happened with past earnings.

Stock indexes are overbought and are chugging higher on light volume, but the trends remain up until they aren’t. Caution and tight stops are warranted.

Stocks index futures and crude light futures are down this morning as I write this, and bonds and the Dollar Index are up. Draghi made comments about how he fears permanent damage in the EU economy if progress is not made soon. The DAX is down 1.20% on his comments.

STOCK MARKET EARLY MORNING INSIGHTS

Stock Market Early Morning Insights is a product of Ron Brown Investing. The complete report and all the charts are produced daily before the market opens and distributed by email to subscribers. Reports published on the HGSI Blog are delayed and do not contain all the charts. For more information about subscribing use this link. MORE INFO

Comments are closed.